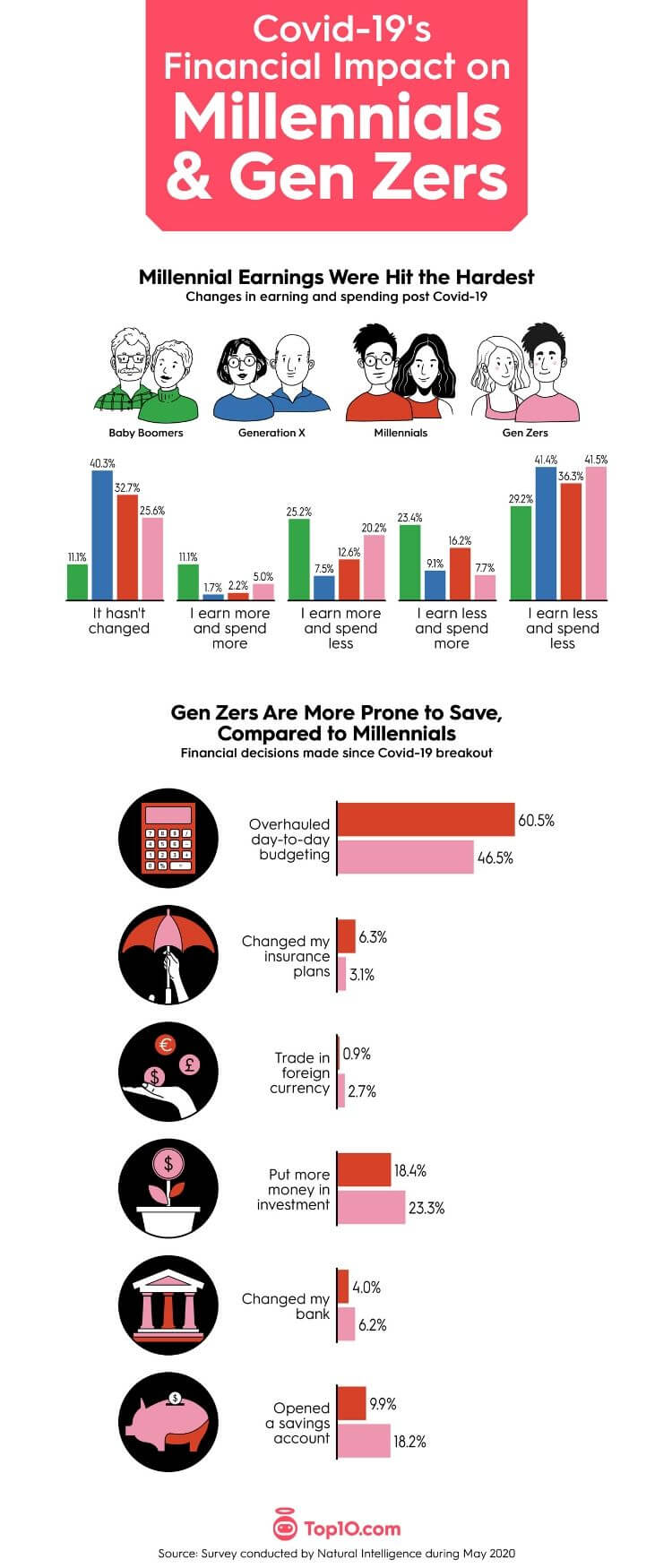

A survey, conducted by Natural Intelligence in May with over a 1,000 respondents, shows that millennials’ earnings were hit the hardest, with over 50 percent reporting they are making less due to the virus. Gen Zers have also taken a hit financially and 48 percent have either lost their jobs or say they are unsure about the future of their job.

However, now is not the time to be overwhelmed by negative news. Instead, realize that this is the ideal time to stabilize your financial future.

Now Is the Time for an Emergency Fund

A vast majority (73%) of millennials are using their stimulus money for pressing needs, such as buying groceries and repaying their debt rather than putting it into savings and investments. This infers that many millennials started the 2020 year with little to no emergency savings.

Many financial experts recommend saving three to six months’ worth of living expenses, but even having $1,000 in a separate account can give you enough financial cushion for dire emergencies, like a trip to urgent care. The more uncertain your employment looks, the more you should set aside for emergencies.

If you don’t have an emergency fund established, make this your first priority. Starting an emergency fund from scratch can feel daunting, but try not to focus on how far you have to go to reach $1,000 or three months’ worth of living expenses. Instead, determine how much money you can sock away to your emergency account each month.

You might be able to find some wiggle room in your budget, such as cutting out fast food or canceling a monthly subscription. Another way to free up more money in a tight budget is to refinance loans that could benefit from a lower APR. For example, right now is an opportune moment to do a mortgage refinance and take advantage of low rates. Securing a lower rate will help you pay less in the life of your home loan, as well as see a decrease in your monthly mortgage bill. Even homeowners with bad credit might benefit from a refinance.

If a mortgage refinance is the right financial move for you, the timing of your refinance might allow you to delay a month of payment. This will allow you to pay your mortgage payment straight to your emergency fund. If the refinance allows you to pay $50-$100 less each month, make sure that savings are automatically transferred into your emergency fund. This strategy will allow you to quickly build up emergency savings without having to drastically adjust your budget.

Don’t Underestimate the Power of Saving Money

Along with setting up and regularly contributing to an emergency fund, it is wise to save wherever possible. Our survey showed that more than 60 percent of the Gen Zers have been spending less. Not all individuals share the same sentiment about spending less during this time, though. On the whole, 38% of respondents of all age groups said they haven’t changed their spending habits.

While the lockdowns and grocery store uncertainties make spending less challenging, it is not impossible. There are several painless ways to cut back your spending $100-200 per month including:

- Evaluate your eating out budget. Are there simpler meals you can make at home for less?

- Downgrade your phone plan. If you don’t need to rely on data right now, try downgrading your plan or calling about promotional offers.

- Pause subscriptions. Can you forgo your favorite TV streaming channel, subscription box or membership fee for a month or two?

- Keep groceries simple. Build meals from what you have on hand or cheap staples, such as rice, beans and chicken legs versus expensive nuts and steaks.

- Try a spending freeze. Challenge yourself to go 30 days without buying clothes or a week of not spending any money except for essential bills.

Another simple way to save more money during this time is to look at your current banking choice. Are you wasting money here and there for silly fees, such as ATM fees or monthly account fees? Do you receive late fees when you forget to pay a bill on time? If you said yes to either of these questions, it might be time to shop for a new bank.

Online banking streamlines your finances and ultimately saves you time. Many online bank accounts also have higher-yielding APY accounts, allowing your savings to grow faster than a traditional bank. More importantly, online banks keep you safe during this uncertain time. You don’t need to waste time standing in line at the bank, you can do everything from your phone.

Surprisingly, Gen Zers are more aware of the importance of saving, with over 18% stating they responded to Covid by opening a savings account, compared to almost 9% of Millennials. Further to that, Gen Zers also led the charts in the decision to put their stimulus money into a savings account.

Boosting your savings is easier than you think, especially if you schedule automatic deposits into your savings account. If you set up your bank account to automatically place $3 per day into a savings account, you would have effortlessly saved $1,095 in a year.

Stay on Top of Debt Repayment

The survey results showed that the top earners polled are focused on retirement savings, while those in the lower-income brackets are worried about housing costs and debt. Twenty-five percent of Gen Zers expressed concern with student loan debt. No matter what your current debt load is, you don’t want to ignore it during this time. There are a few different options to make repaying debt more manageable.

First, student loan refinance is a good option for those who are seeking a lower APR. Also, if your credit score has improved since you first took out your loans, you might qualify for a better rate. While both federal and private school loans can be refinanced together, it is a good idea to keep your government loans untouched. Instead, contact your federal loan provider for repayment options.

Second, debt consolidation is available for those who are struggling to stay on top of payments. It is important to pick the right debt consolidation loan for your financial situation, but doing so can help you combine all of your debts into one monthly payment. Since credit card APR can vary greatly, consolidating different debts under one loan can even save you money if the APR is lower.

Will COVID Be Your Financial Wake Up Call?

While this crisis has been detrimental in many ways, it has also pushed people to think about their future and to revise their spending habits and save money. Even those who thought they were financially secure at the beginning of 2020 are realizing that anything can happen, and it is best to be prepared for anything. Now is your time to take the small steps to secure your financial future.

Millennials and Gen Zers were facing multiple financial challenges, such as a growing student debt and very little security in retirement. But now, with the unraveling financial crisis, it is even more important for young people to be aware of how they spend and save their money.

.20200607063304.jpg)