However, you may want to consider the following before deciding on which of these options is right for you.

How Long Do You Plan to Stay in Your Home?

Most people don’t stay in their home for the full duration of a 30-year or even a 15-year mortgage, but regardless – you’ll need to stay in your home for a few years for buying it to make financial sense. The general rule of thumb when purchasing a house is that you should stay in it for at least 5 years, although the exact figure varies based on your location and what it would cost you to rent for the same price.

The first reason to think about this is closing costs. Each time you take out a mortgage, you pay closing costs: these are upfront, non-refundable fees reaching into the thousands of dollars for things such as loan origination, home appraisal, title insurance, surveys, taxes, and credit checks. For argument’s sake, let’s say your closing costs reached $3,700, the median given in a recent national survey. If you stay in your home for 5 years, your closing costs were effectively $740 per year. But if you stay in your home for 2 years, that’s effectively $1,850 for each year you spent in the home before moving to another property.

The second reason is your monthly payments. Borrowers typically pay higher interest in the first few years of a mortgage, and therefore it usually takes around five years to have paid down enough of the principal in order for the home purchase to have made sense.

The case for buying a home becomes stronger with every year in which you reside in that home. There are many online calculators available to help you determine if buying a home makes sense: as a general rule, if you only stay in your home for 1 year, it makes sense to rent if you can find a similar home at less than $2,500-3,000 per month. If you’re planning to stay for 2 years, then renting suddenly makes sense at about half that price - $1,250-1,500 per month. After about 5 or 6 years, things flatten out and renting only makes more sense than buying if you can rent a similar home for less than $1,000.

Of course, these calculators don’t take into account the potential appreciation of your home—if you purchase for $300,000, and you sell it for an additional 20%, that’s $60,000 in your pocket that you wouldn’t have had access to if you were renting.

What Are the Mortgage Rates Like?

Another important thing to think about is the current mortgage rates. You’ll probably start out by comparing the price of renting a home to the price of buying one, but how much interest are you likely to pay over the life of your mortgage? Although property prices are higher than ever in many parts of the U.S., interest rates are at historic lows – and this helps the case for purchasing.

Today, it is common for lenders to offer rates of around 4-4.5% on 15-year or 30-year fixed-rate mortgages. Until 2010, the idea of a mortgage loan being offered for less than 5% would have been unthinkable. Before 2000, it was impossible to find anything under 8%. From 1979 to 1990, the average annual interest rate on a 30-year fixed-rate mortgage never dipped below 10%.

Of course, your own credit status and financial status will have a large bearing on whether lenders offer you a low rate. But if they do offer you something in the 4-5% APR range – that’s a strong tick in favor of buying.

Taxes vs Tax Deductions

Although federal, state and local property taxes are a necessary part of owning a home, the good news is that such payments have always been tax deductible. Under the federal tax reforms coming into effect in 2026, these deductions are capped at $10,000.

Renters can’t deduct rent payments from their federal income tax. However, if their lease requires them to make property tax payments, then those payments are tax-deductible.

Both homeowners and renters are theoretically eligible for home office deductions, which are calculated by dividing the size of the home office by the size of the home. Homeowners can deduct for things like home owners’ insurance, security, general repairs and maintenance, and utilities. Renters can deduct for utilities and any other relevant costs which they are required to pay under their lease agreement. As with anything tax-related, your accountant is the person to speak to about deductibles.

Initial Costs vs. Recurring Costs

When taking out a mortgage on a new home, the initial cost usually consists of the closing costs and the down payment. The recurring costs consist primarily of the monthly mortgage payment, plus additional property taxes, insurance, and maintenance fees.

Many renters are surprised to discover that renting involves more than just monthly fees to the landlord. Before signing a contract, it’s important to ask the landlord to list all the fees that can be expected. Some initial costs to look out for: application fee, deposit, and moving-in fees (or first month’s deposit). Recurring costs to look out for: renter’s insurance and property taxes.

Of course, homeowners and tenants alike can expect to pay the usual monthly fees for utilities like electricity, water, phone, cable, and internet.

What Does the Future Investment Market Look Like?

Lastly, a home purchase is an investment—in fact, for many people, it’s the biggest investment they’ll ever make—and therefore it’s crucial to have an understanding of the direction in which property prices are headed. Investment isn’t a perfect science, but nonetheless it is worth reading up on the property market at the time and specifically in the area in which you’re thinking of buying:

Some questions to start with:

- What is the current trend in local, state, and federal property prices?

- What is the median price for properties in the neighborhood?

- Are there any major infrastructure or transportation projects happening in the area?

- Are there any other things happening locally that might make it a good growth area?

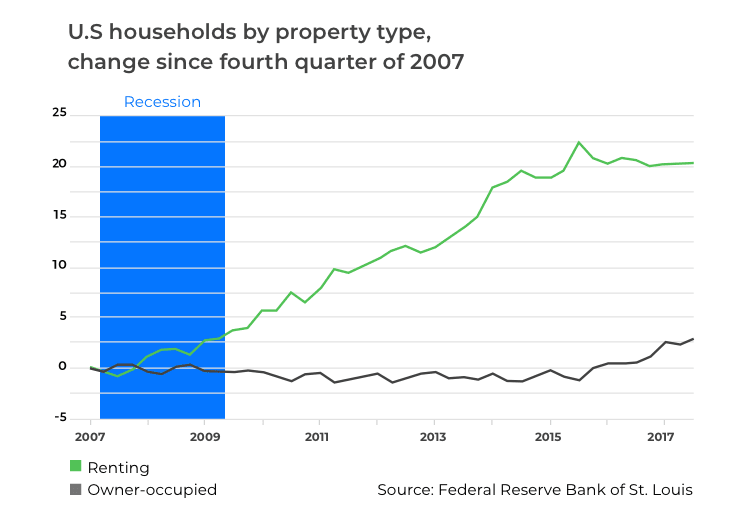

As you can see, increasing numbers of homes are not lived in by their owners, which means you can invest without needing to live there.

So, Should I Rent or Buy?

As you can see, the decision of whether to rent or buy revolves around more than just whether or not you can afford to make a down payment on a mortgage. It requires you to weigh up a variety of factors, such as: how long you are planning to stay in your home, what sort of rate lenders are willing to offer you, and what the future investment market looks like. As with any major financial decision, each person will come to a different conclusion based on their own individual financial circumstances.

For further information on interest rates and terms see these in-depth reviews of the leading mortgage lenders.